Powering the Future of Digital Finance

OpenFactor is a global technology solutions and services provider redefining digital transformation in financial services. Headquartered in Johannesburg, South Africa, and operating across four continents, we modernize legacy systems, engineer next-generation digital platforms, and expand financial access at scale. With deep domain expertise and advanced capabilities, we enable banks, insurers, fintechs, and financial institutions of all sizes to scale with agility, compete with confidence, and thrive in the digital economy—delivering measurable impact with cost efficiency at the core.

Our comprehensive suite of solutions spans the full spectrum of digital finance: core banking, digital lending, wallet infrastructure, agency banking, payment processing, AML and fraud detection, compliance, and verification platforms. By combining industry expertise, open technology frameworks, and AI-driven innovation, we help institutions accelerate growth, enhance customer experiences, and adapt seamlessly to change. Guided by integrity, professionalism, and purpose, OpenFactor is shaping the future of financial technology—across Africa and around the world.

We deliver with a partner-driven approach, aligning technology and affordability to help clients scale in fast-changing economies.

How We Build

- Security-first, compliance-ready by design (PCI DSS, GDPR).

- Composable architecture: build only what you need, when you need it.

- Open APIs—interoperability across partners and markets.

- Affordability without compromise; optimize for TCO.

- Inclusive-by-default UX for high-growth & underserved markets.

- Measured delivery: discovery → pilots → scale with telemetry.

Product Co-Creation

We shape roadmap and UX together with your teams—co-design sprints, rapid prototyping, and structured pilots.

Implementation & Migration

From legacy-to-modern cutovers (core, payments, insuretech) to phased data migration with zero-downtime windows.

Managed Services

SLA-backed operations for cloud, hybrid, or on-prem—observability, upgrades, and compliance reporting included.

Enablement & Support

Developer docs, sandboxes, and capability academies for your engineers, ops teams, and partner ecosystem.

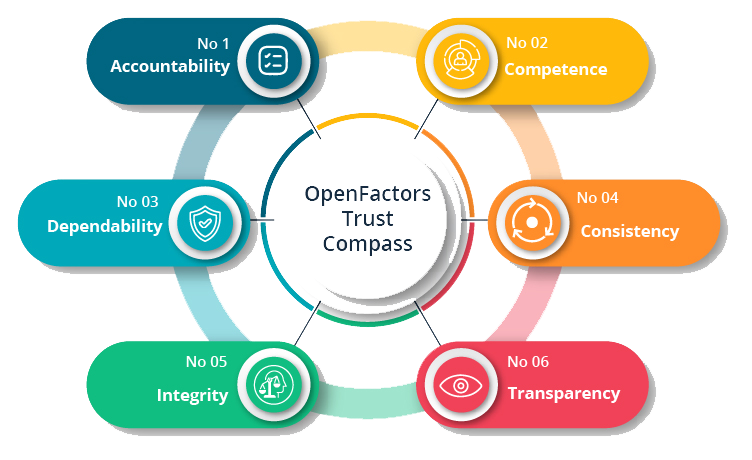

Trust Is Our Business Imperative

Our corporate culture is built on Trust. We see every engagement with our esteemed customers as a unique opportunity to build an enduring bond based on Trust.

Our business philosophy stems from our intrinsic ability to infuse disruptive capabilities, our uncompromising focus on quality, and our resolve to be a force to be reckoned with in Africa and beyond.

Mission, Vision & Values

The principles that power how we build, deliver, and partner.

OpenFactor's Mission

Our mission is to infuse innovation and affordability into digital platforms and infrastructure, enabling clients to scale, adapt, and lead in fast-changing economies.

OpenFactor's Vision

To become a global leader in financial technology innovation, delivering solutions that transform how financial services are delivered, accessed, and experienced worldwide.

Integrity

We operate with transparency, honesty, and accountability in every engagement.

Professionalism

We uphold the highest standards of quality and expertise in all that we do.

Innovation

We embrace technology as a catalyst for growth, driving creativity and transformation.

Affordability

We design solutions that are accessible and cost-effective, ensuring value for every client.

Our Journey

Milestones in our mission to transform financial services.

Full operation commenced

Began full operations with focus on modernizing financial infrastructure.

MInsure Launch

Expanded into insuretech—microinsurance workflows enabling access for underserved communities.

Launched FinSys Core Banking

FinSys Core Banking platform launched, powering digital banks and neobanks across Africa.

10M+ End-customers

Hit a major adoption milestone across customer ecosystems and channels.

First Project delivered beyond Africa

Crossed continental boundaries with our first project in Singapore.

FinSys Core Banking 2.0 launched

Cloud-native rearchitecture of FinSys Core Banking with microservices, event sourcing, and real-time processing.

Where We Operate

Strategic hubs across Africa and beyond—combining local expertise with global reach.

South Africa

Headquarters

Nigeria

Regional HQ - West Africa

Kenya

Regional HQ - East Africa

Mauritius

Hold Co.

Zimbabwe

Regional Office

United States

Global Operations Hub